Understanding Crypto Wallets: A Complete Guide

In the rapidly evolving world of cryptocurrencies, one of the most essential tools for managing your digital assets is a crypto wallet. Whether you’re new to the cryptocurrency space or a seasoned investor, understanding how crypto wallets work is crucial for safeguarding your assets. This article provides a comprehensive overview of trust wallet, explaining what they are, types available, and why they’re necessary for anyone dealing in digital currencies.

What is a Crypto Wallet?

A crypto wallet is a digital tool that allows users to store, send, and receive cryptocurrencies like Bitcoin, Ethereum, and many others. It works similarly to a traditional wallet, but instead of holding physical cash, it holds the private keys needed to access and control your crypto funds on the blockchain.

The wallet doesn’t actually store your cryptocurrency directly. Instead, it stores the cryptographic keys—public and private—that enable transactions on the blockchain. The public key is like your account number, while the private key is akin to a password that you must keep secure.

Types of Crypto Wallets

Crypto wallets come in various forms, each with its own set of features, security levels, and convenience. Below are the primary types of crypto wallets:

1. Hot Wallets

Hot wallets are connected to the internet, making them convenient for quick transactions. They are typically software-based and can be accessed via your computer or mobile device. While they provide easy access to your funds, the downside is that they are more vulnerable to online threats such as hacking.

Examples of Hot Wallets:

- Web Wallets: Accessed through a web browser, they are often provided by cryptocurrency exchanges like Coinbase or Binance.

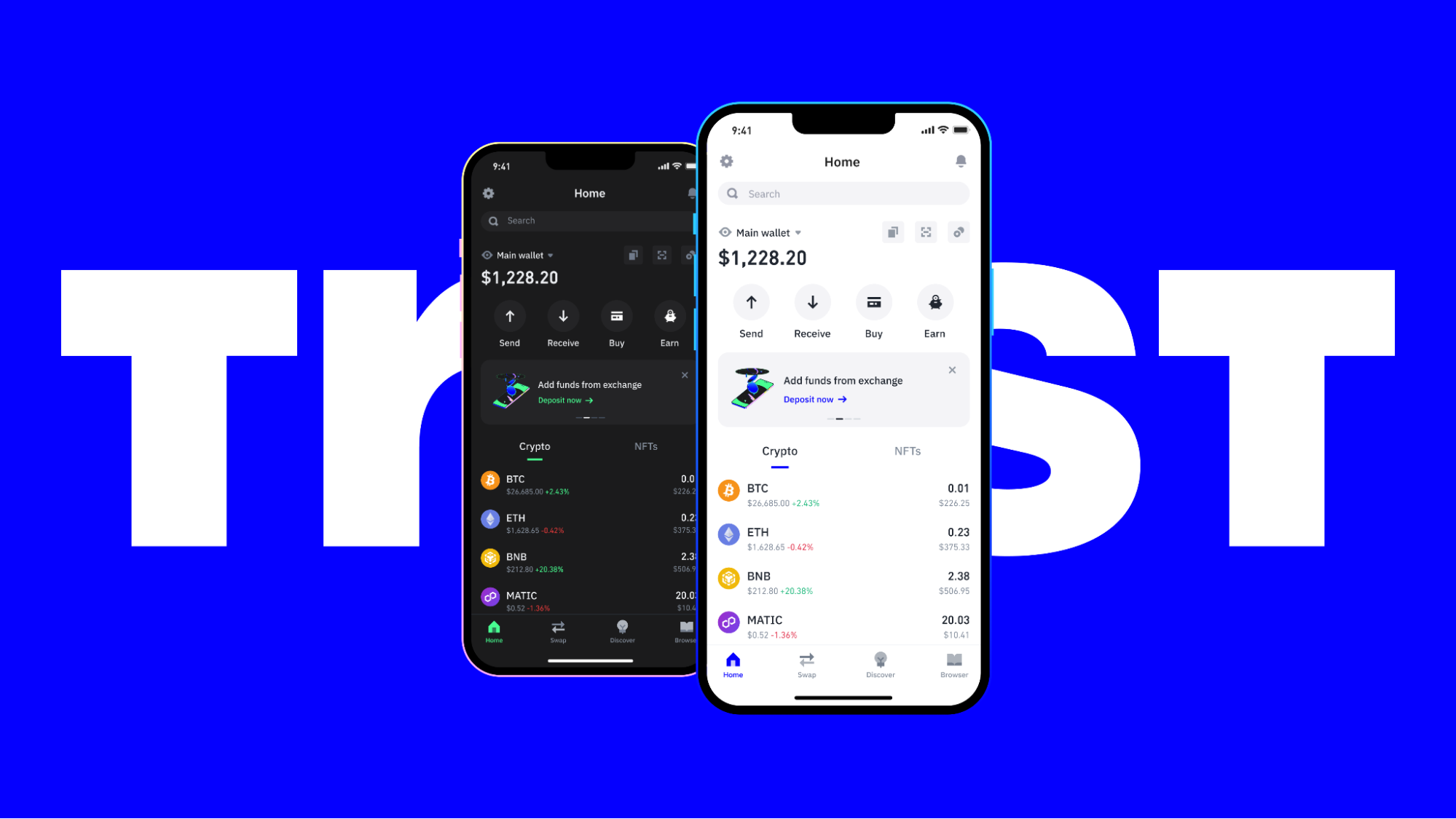

- Mobile Wallets: Apps on your phone, such as Trust Wallet and MetaMask, which allow you to manage your crypto assets on the go.

- Desktop Wallets: Software installed on your computer that provides full control over your digital assets, like Exodus or Electrum.

2. Cold Wallets

Cold wallets, on the other hand, are offline and not connected to the internet, which makes them far more secure from online hacking attempts. These wallets are ideal for long-term storage of cryptocurrencies, as they offer a higher level of security but lack the convenience of hot wallets for frequent transactions.

Examples of Cold Wallets:

- Hardware Wallets: Physical devices like Ledger Nano S or Trezor, where private keys are stored offline.

- Paper Wallets: A physical document with your private and public keys written on it, which you can store securely offline.

How Do Crypto Wallets Work?

When you receive cryptocurrency, the transaction is recorded on the blockchain. Your crypto wallet stores the private key associated with your assets. To send cryptocurrency, you use your private key to sign a transaction, which is then verified by the blockchain network.

It’s important to understand that the wallet itself doesn’t hold the cryptocurrencies, but rather gives you access to the blockchain, where your assets are stored. Think of the wallet as a tool that enables you to interact with your digital assets.

The Importance of Security in Crypto Wallets

Since crypto wallets are the gateway to your digital assets, ensuring their security is paramount. Losing access to your wallet or having it compromised can result in the loss of your funds. Here are some crucial security tips:

- Backup Your Wallet: Always back up your wallet’s private key or seed phrase, preferably in multiple secure locations (e.g., a safe or encrypted storage).

- Use Strong Passwords: Protect your hot wallets with strong, unique passwords. For hardware wallets, use a PIN.

- Enable Two-Factor Authentication (2FA): For extra security, enable 2FA on platforms that support it.

- Update Your Wallet Software: Keep your software wallets up to date to avoid security vulnerabilities.

- Be Wary of Phishing Attacks: Be cautious about clicking links in emails or messages that could lead to fraudulent websites attempting to steal your information.

Advantages of Using Crypto Wallets

- Complete Control: With crypto wallets, you have full control over your digital assets without relying on third parties like banks.

- Anonymity: Many wallets, especially when using cryptocurrencies like Bitcoin, allow for anonymous transactions, enhancing privacy.

- Global Accessibility: Crypto wallets can be accessed from anywhere in the world, making them a great option for international transactions.

- Security: By using cold wallets and securing your private keys, you can minimize the risk of theft or loss.

Disadvantages of Using Crypto Wallets

- Loss of Private Key: If you lose your private key or seed phrase, you may lose access to your crypto forever.

- Risk of Online Attacks: Hot wallets are susceptible to hacking and other forms of cyber attack, although the risk can be mitigated with proper security practices.

- Complexity for Beginners: For those new to cryptocurrencies, the different types of wallets and security measures can seem overwhelming at first.

Conclusion

A crypto wallet is an essential tool for anyone involved in the cryptocurrency space. Whether you choose a hot or cold wallet, it’s important to prioritize security and ensure you back up your keys and passwords. By understanding the basics of crypto wallets, you can take control of your digital assets, enjoy the benefits of cryptocurrency, and safeguard your investments in the ever-changing crypto market.